Calculate your carbon footprint: anticipate the carbon tax and reduce your costs

Combating climate change and reducing fossil fuel consumption are at the heart of international commitments to a sustainable future. The Net Zero Initiative, driven by the Paris Agreement and environmental policies, sets a clear objective: to encourage companies to adopt strategies aligned with the energy transition. Against this backdrop, the CSRD, which came into force on January 1, 2024 in France, marks a major turning point by reinforcing the requirement for transparency on ESG commitments.

Les organisations doivent désormais publier des informations détaillées sur leur durabilité et intégrer le calcul de leur empreinte carbone comme un outil clé pour répondre à ces nouvelles exigences. Au-delà de l’aspect réglementaire, cette démarche permet d’anticiper les impacts financiers des taxes carbone et d’optimiser la gestion des ressources.

Measuring greenhouse gas (GHG) emissions is no longer just a responsible initiative, but a genuine strategic lever. It's an opportunity to better identify sources of carbon impact, rationalize our energy footprint, and set our organization on an environmentally-friendly course.

Anticipating, taking action and transforming climate challenges into strategic opportunities: these are the keys to achieving your goal of controlling your carbon footprint in a rapidly changing world.

1. Measuring your carbon footprint: a strategic necessity

1.1. The carbon tax, a significant issue

1.2 Reliable methods for accurate diagnosis

2. Taking action to reduce our carbon footprint and control costs

2.1 Identify the main sources of carbon footprint

2.2. Drawing up an effective action plan

3. Anticipate and optimize with GCI solutions

3.1. Forecasting the financial impact of carbon taxes

3.2. GCI expertise: tailor-made support for your low-carbon strategy

Measuring your carbon footprint: a strategic necessity

⁉️La carbon tax, a significant issue

Since the introduction of carbon taxation in France in 2014, companies have faced increasing tax pressure linked to their carbon footprints. In France, the carbon tax amounts to €44.6/t CO2 eq per tonne of CO₂, covering 35% of emissions, mainly in transport, residential, tertiary and industry excluding ETS.

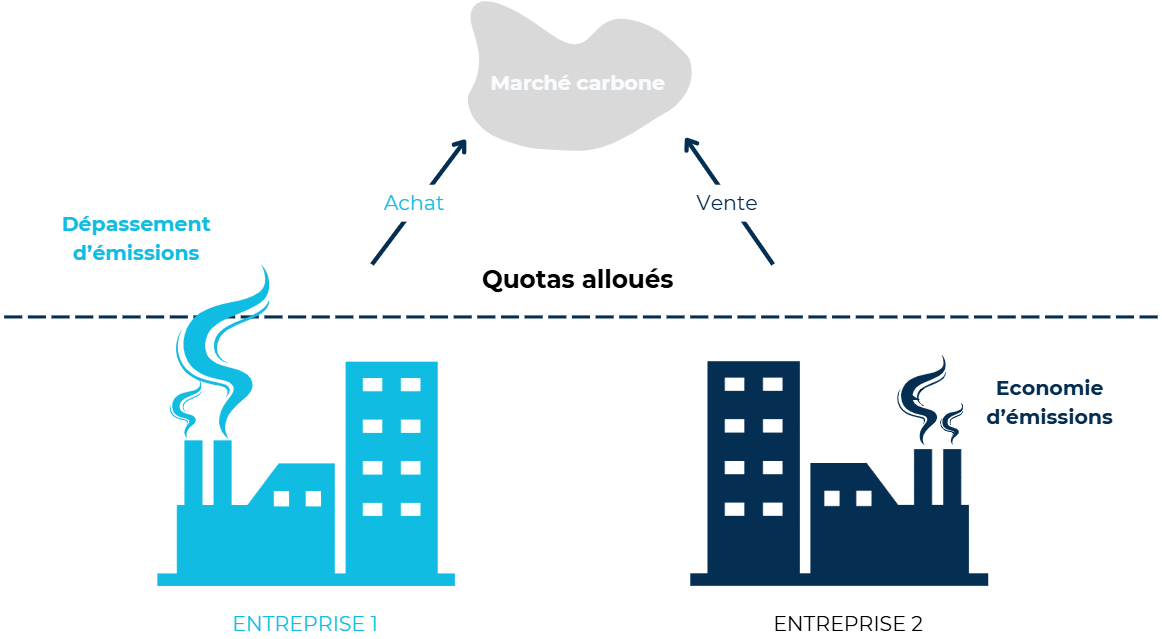

At the same time, the European carbon market (EU ETS), which covers almost 40% of the European Union's GHG emissions, plays a key role in climate regulation. It imposes a carbon emission cap on the most polluting industries and frames their operations by requiring the purchase of quotas for each tonne of CO₂ emitted above this threshold. This system encourages a gradual reduction in the use of polluting fuels, thus contributing to the transition to a more sustainable economy, contributing to the goal of carbon neutrality.

The carbon market

This upward price trend is designed to encourage organizations to reduce their GHG footprint and adopt more sustainable practices.

Carrying out a GHG assessment enables a company to identify the main sources of emissions, enabling it to implement strategies to reduce them. This proactive approach offers several advantages:

- Cost reduction: By identifying energy inefficiencies, companies can reduce their energy consumption, which translates into significant financial savings, given the rising price of carbon tax.

- Anticipation of carbon taxes: By knowing their carbon footprint precisely, they can anticipate the costs associated with carbon taxes and adapt their strategies accordingly, while strengthening their insurance against the financial and regulatory risks associated with environmental change.

- Strengthening competitiveness: Committing to reducing its carbon footprint meets the growing expectations of consumers and business partners in terms of sustainability, thus improving their brand image and market position.

By accurately calculating their carbon footprint, organizations can better manage their energy consumption and limit their dependence on fossil fuels. By integrating this approach into their strategy, they adopt a more ecological approach while strengthening their resilience in the face of climate challenges.

📊 Reliable methods for accurate diagnosis

In France, the BEGES is a legal obligation for certain entities, notably companies with more than 500 employees, local authorities with more than 50,000 inhabitants and public establishments with more than 250 employees. These organizations must produce and publish their BEGES every four years for private-sector entities, and every three years for the State and local authorities.

The Bilan Carbone® methodology is based on recognized international standards, such as ISO 14064-1 and the GHG Protocol. It aims to quantify direct emissions (Scope 1) and indirect emissions linked to energy consumption (Scope 2), as well as Scope 3 emissions with the entry into force of the CSRD directive, thus providing an exhaustive view of an organization's carbon footprint. A number of technological tools are available to help organizations produce their BEGES. These include the use of a carbon footprint calculator integrated with a specialized platform such as Global Climate Initiatives (GCI), which offers structured support in line with current regulations.

In addition, detailed analysis of the sources emitted facilitates identification of the main levers for reduction, particularly in relation to the use of non-renewable energies. By adopting more sustainable solutions, organizations can combine regulatory compliance with environmental commitment, thereby actively contributing to sustainable development.

Take action to reduce your carbon footprint and control costs

Once the carbon footprint has been measured, the next step is to identify the levers for action to reduce the company's environmental footprint and anticipate the financial impact of climate regulations. It's not just a question of complying with legal obligations, but also of transforming this constraint into a strategic opportunity.

💡 Identify the main sources of the carbon footprint

The carbon impact analysis is based on the three Scopes methodology:

- Scope 1: Direct emissions from sources controlled by the company (fuel combustion, industrial processes, etc.).

- Scope 2: Indirect emissions linked to purchased energy consumption (electricity, steam, heat, cooling).

- Scope 3: Other indirect emissions generated throughout the value chain (purchasing, transport, waste, product use, etc.).

With the entry into force of the CSRD, Scope 3 becomes a key element of extra-financial reporting, obliging organizations to integrate the entire carbon footprint of their ecosystem into their low-carbon strategy.

Identifying high-impact items enables us to prioritize reduction actions according to potential savings and optimization opportunities. A company whose carbon footprint is mainly energy-related, for example, could prioritize energy efficiency and renewable self-consumption, while an organization with a high Scope 3 footprint would need to rethink its purchasing and logistics policies.

🎯 Drawing up an effective action plan

Once the main sources of carbon emissions have been identified, a GHG reduction plan can be put in place in several areas:

✅ Optimizing energy consumption

- Energy audits to identify potential gains.

- Modernizing equipment and improving the energy efficiency of buildings and industrial processes.

- Development of energy-saving strategies (LED lighting, automation, intelligent flow management).

✅ Transition to a low-carbon strategy

- Development of renewable resources (solar, wind, biomass) and reduction of fossil fuels.

- Buying green electricity or adopting self-consumption projects not only helps to limit carbon footprints, but also to meet growing regulatory requirements.

- In the mobility sector, the integration of hydrogen and alternative fuels is becoming a priority. To encourage organizations and individuals to opt for clean vehicles, tax incentives have been stepped up.

The eco-tax and malus on polluting vehicles now penalize models with high CO₂ emissions, making the purchase of combustion-powered vehicles more expensive. Conversely, exemptions and subsidies have been introduced to encourage the acquisition of electric or hybrid vehicles.

These measures are part of an overall strategy to accelerate the sustainability process and reduce the environmental impact of the industrial and transport sectors.

✅ Reducing carbon impact across the value chain

- Selection of suppliers committed to low-carbon initiatives.

- Transport optimization and sustainable logistics (electric fleet, rail transport, shared deliveries)

- Eco-design of products and reduction of waste by promoting the circular economy.

✅ Monitoring and continuous improvement

- Establish performance indicators to measure the effectiveness of actions.

- Integration of a carbon offsetting approach to neutralize residual emissions.

- Regular GHG assessments to adjust and fine-tune reduction strategies.

Thanks to these actions, companies not only reducetheir environmental impact, but also improve their economic resilience in the face ofrising energy costs and carbon taxes.

Anticipate and optimize with GCI solutions

Faced with rising carbon prices and intensifying environmental regulations, companies need to anticipate the financial repercussions of their carbon footprint. Like insurance, proactive management of carbon emissions helps limit economic risks and avoid unforeseen charges. In many countries, carbon taxes are applied directly to energy products such as petrol, increasing the amount borne by businesses and consumers alike. What's more, this tax is often combined with VAT, further amplifying the financial impact. Mastering the definition and mechanisms of carbon taxes is therefore an essential strategic lever for optimizing costs and reducing emissions.

✅ Forecasting the financial impact of carbon taxes

Legislative changes, combined with the gradual increase in carbon taxes, require rapid adaptation to avoid rising costs. Thanks to high-performance analysis tools, GCI solutions enable :

- Estimate future costs linked to carbon taxes by integrating carbon market developments (ETS quotas, carbon taxes) into financial scenarios.

- Identify tax optimization levers, using precise data from carbon footprint calculations, to adjust strategies and reduce unnecessary expenditure.

By adopting a forward-looking vision, organizations can prepare for their ecological adaptation with peace of mind, while keeping their budgets under control.

🔑 GCI expertise: tailor-made support for your low-carbon strategy

Global Climate Initiatives offers tailor-made support to help organizations effectively manage their low-carbon trajectory. The aim: to combine regulatory compliance, carbon footprint reduction and sustainable value creation.

1️⃣Un integrated carbon footprint calculator, compliant with international standards (ISO 14064-1, GHG Protocol), to accurately measure emissions on Scopes 1, 2 and 3.

2️⃣Une interactive platform offering a centralized view of data, simplifying the monitoring and analysis of results to guide strategic decisions.

3️⃣Une a team of climate engineers trained in Bilan Carbone® methodology to guide companies through every stage of the process, from data collection to the implementation of action plans.

By accurately assessing their carbon footprint and greenhouse gas emissions, organizations can not only comply with ever-changing regulations, but also optimize their operations to reduce their dependence on non-renewable resources. Anticipating constraints, such as the introduction of new environmental taxes, helps to integrate the ecological transition into a sustainable development strategy.

Acting now means meeting climate challenges while ensuring a resilient and responsible trajectory; an approach that involves individuals, households and organizations alike. In France, the carbon tax plays a central role in regulating carbon footprints, influencing the price of fossil fuels and prompting organizations to adapt their models. A better understanding of its definition and impact enables us to anticipate regulatory changes and adopt appropriate strategies. By proactively integrating these challenges, they strengthen their resilience in the face of future economic and environmental change.

Thanks to high-performance tools and expert support like those offered by GCI, they can transform these challenges into opportunities, aligning sustainability and competitiveness.