CSRD: the complete guide to preparation

The CSRD (Corporate Sustainability Reporting Directive) is a new directive proposed by the European Commission and adopted by the European Parliament in March 2022 to impose and provide a better framework for corporate extra-financial reporting.

It is scheduled to come into force on January 1, 2024.. It will impose on the companies concerned a new communication format on information relating to CSRissues, as well as on the alignment of business activity with a "sustainable" business model.

1. Why this regulatory change?

What's changing: the perimeter

What's changing: sanctions

2. Which companies are concerned by CSRD?

3. What are the CSRD deliverables?

4. What is the CSRD timetable?

5. CSRD: how our GCI platform can help you

Bilan Carbone

Objectives, trajectories and commitments

Transition Plan

The company's energy mix

Financing GHG sequestration and climate change mitigation projects

Why this regulatory change?

The CSRD (Corporate Sustainability Reporting Directive) is a new directive proposed by the European Commission and adopted by the European Parliament in March 2022 to impose and provide a better framework for corporate extra-financial reporting.

It is scheduled to come into force on January 1, 2024. It will impose on the companies concerned a new format for communicating their information on CSR issues, but also on the proper alignment of business activity with a "sustainable" model.

⚠️ What's changing: the scope

The CSRD introduces the concept of double materiality to enable organizations to better take climate risks into account in their decision-making:

- Financial materiality

- Environmental, social and governance materiality or "impact materiality".

In other words, we need to examine the impact of the deterioration in societal, environmental and governance conditions on the company's activity, but also take into account the impact of the company's activity on these same conditions. It's a double cause-and-effect relationship (double materiality).

The companies concerned will be required to publish the proportion of their sales, capital expenditure (Capex) and operating expenditure (Opex) derived from environmentally and socially sustainable activities.

One of the challenges of the new reporting is in fact the integration of the data requested by the June 2020 European regulation on green taxonomy, which imposes a classification of an organization's activities according to certain environmental criteria.

⚠️ What's new: sanctions

Penalties in the event of infringement are not yet specified, and will be defined by each EU member state. However, the European Parliament's Directive of December 14, 2022 states that measures must be "effective, proportionate and dissuasive".

Which companies are concerned by CSRD?

The CSRD is expected to quadruple the number of companies required to comply with the directive compared with the NFRD. In fact, the NFRD target concerned around 10,000 companies, whereas the CSRD should concern more than 50,000.

Indeed, the new system is no longer limited to companies with over 500 employees, but now extends to many companies with over 250 employees, and to virtually all listed companies, including a large proportion of SMEs, which were previously excluded.

🏢 The CSRD will concern listed companies exceeding at least 2 of the following criteria:

For large listed companies:

- 250 employees

- 20 million euros balance sheet total

- 40 million in net sales.

For listed SMEs:

- Between 10 and 250 employees,

- Between 350 K€ and 20 M€ of total balance sheet.

- Between 700 K€ and 40 M€ net sales.

🇪🇺 The CSRD will also concern non-European companies operating on the European continent:

- Net sales in Europe > €150M

The European Union also encourages other companies (SMEs and unlisted entities) to publish their non-financial reports. The text, and EFRAG in particular, defines specific reporting standards for these organizations.

What are the CSRD deliverables?

✅ Non-financial reporting will have to be published according to precise standards published in 2023 by EFRAG (European Financial Reporting Advisory Group), in digital format, to facilitate the use and sharing of this information.

✅ Reporting will have to merge financial and extra-financial risks.

✅ Companies will be required to publish their environmental, social and governance impacts (ESG criteria).

✅ Companies will have to explain their business model, the means they will have put in place to contribute to the ecological transition and specify their plan with monitoring indicators.

✍️ These ESG reports will have to be audited and certified by an independent body, which will verify the sincerity of the information and the presence of sustainability objectives.

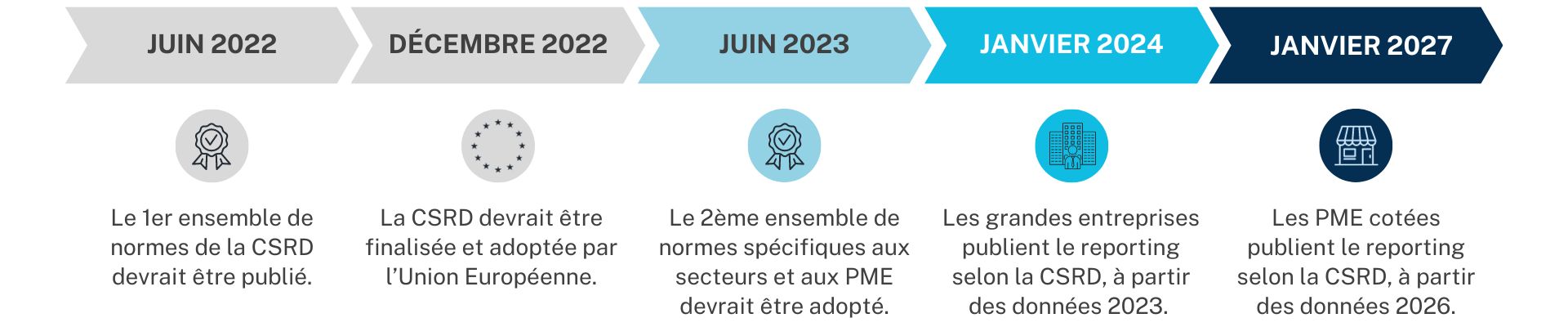

What is the CSRD timetable?

The WEEE Directive will be phased in from January 1, 2024. For certain categories of companies, implementation will be deferred.

CSRD: how our GCI platform can help you

GCI can assist you with the climate change section of the CSRD report:

📊 Carbon Footprint

The standard to be followed will be that of the GHG protocol and/or ISO 14 064. GHG emissions must be accounted for throughout the value chain, covering Scope 1, Scope 2 and Scope 3.

🎯 Objectives, trajectories and commitments.

Each company will have to determine a short-, medium- and long-term trajectory for reducing its GHG emissions, and will also have to explain how it will achieve its targets.

Companies must present :

- A target compatible with a trajectory of +1.5°C compared with the pre-industrial period, in line with the Paris agreements, as well as the actions implemented in the past, present and future, and their impact on the company's emissions.

- A trajectory to 2030, or even 2050 if possible, with a revision of the target and a redefinition of the reference year every five years from 2030 onwards.

🌿 The Transition Plan

Each company will also have to justify the consistency of its reduction/transition plan with its business and financial strategy.

The resources allocated to implementing the transition plan will need to be specified.

The report should also include a full summary of the transition plan, and present the financial means and resources put in place as part of this transition plan, in particular by communicating the significant volumes of CapEx and OpEx mobilized.

Companies will also be required to report annually on their progress in implementing their transition plan.

⚡ The company's energy mix.

Companies will have to disclose their absolute energy consumption, as well as their energy mix. A clear breakdown of energy consumption by energy source should be provided for companies in sectors with a high climate impact (fossil fuels and renewable energies).

💶 Financing GHG sequestration and climate change mitigation projects.

Companies will also have to report on the amount of GHGs removed from the atmosphere and sequestered on a long-term basis. They should be distinguished according to the type of project:

- GHG sequestration within the company's value chain,

- GHG sequestration through projects financed outside the company's value chain.

⭐ Our GCI platform benefits from over 10 years' experience in all these areas. We comply with the standards required by the CSRD, and the ergonomics of our tool are constantly being improved. Don't hesitate to ask our teams for a demo.