What are carbon markets?

Since regulatory approaches to the environment and subsidy policies have not been sufficient to effectively encourage companies to move towards an ambitious decarbonization strategy, which is essential in view of the urgent need to reduce greenhouse gas emissions to combat climate change, Europe created the carbon market (ETS - Emissions Trading System) in 2005.

This emissions trading scheme applies only to industry and power generation until 2024, but will be extended to transport and real estate from 2025.

This economic mechanism was directly driven by the Kyoto Protocol agreements, signed by most industrialized and some developing countries.

Setting targets for the reduction of greenhouse gas emissions, it has proved effective because the price set for exceeding GHG (Greenhouse Gas) emissions, which companies have understood as a "tax", has given them a strong incentive to invest in cleaner technologies, energies and facilities.

As a result, these agreements have encouraged the creation of national emission quota systems and paved the way forcarbon contributions and offsets.

They have become essential tools for engaging companies in climate action, located mainly in the European Union, China, California (USA) and Quebec (Canada).

In Europe, the sectors most concerned by this scheme are naturally the highest emitters, such as power generation, industry, residential and commercial heating, agriculture, and soon transport and real estate.

1. What's the difference between a regulated and a voluntary market?

2.1 The transition to a low-carbon economy

2.2 The importance of international cooperation

What's the difference between a regulated and a voluntary market?

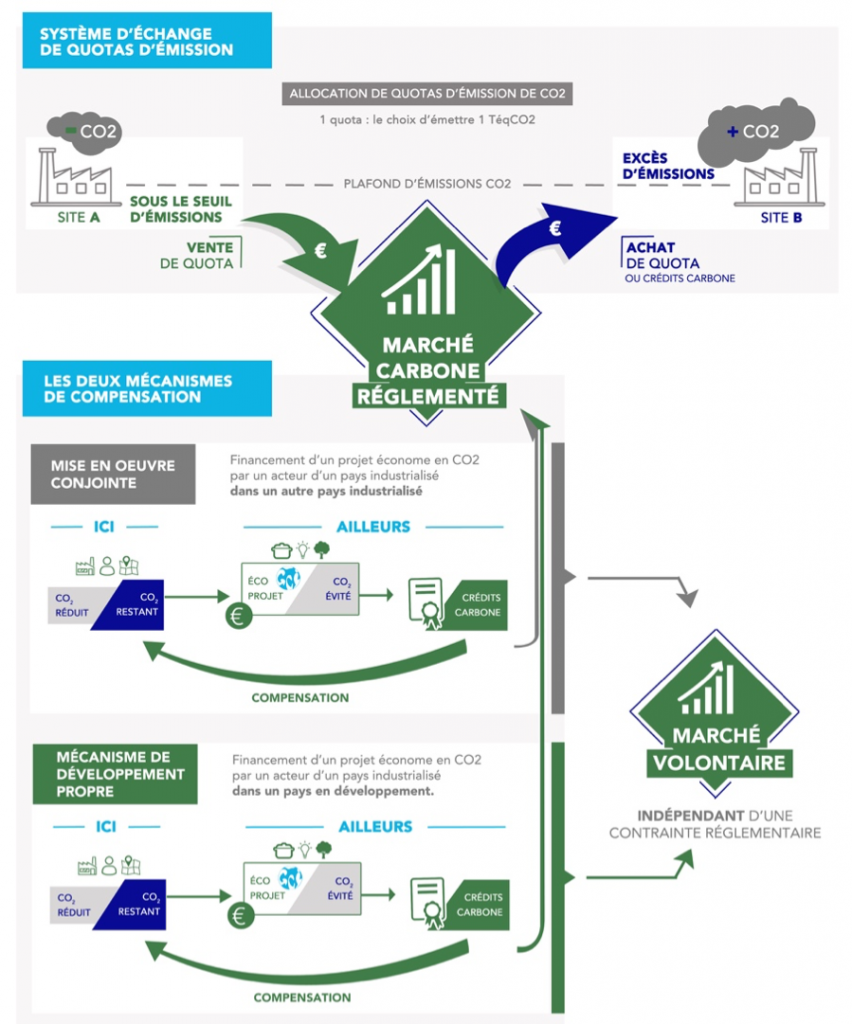

There are two types of carbon markets:

🌿 The regulated market

Also known as the compliance market, it meets regulatory obligations under the Kyoto Protocol. Only countries subject to reduction targets can take part in this market, which includes two types of carbon assets: emission quotas and carbon credits.

🌿 The voluntary market

Alongside the regulated market, other players have decided to offset their GHG emissions on a voluntary basis. All the transactions between them make up the voluntary market, which is not governed by any public institution. Certification labels guarantee the quality of carbon credits.

What are the challenges?

Carbon markets offer a number of advantages, such as the flexibility for economic players to choose the most effective and economical way of reducing their emissions, and the creation of an economic incentive for innovation and the development of clean technologies.

However, certain limitations also need to be highlighted, such as the risk of carbon price volatility and the need for rigorous monitoring and regulation to avoid fraud or double-counting of emissions reductions.

📉 The transition to a low-carbon economy

Carbon markets are an integral part of the transition to a low-carbon economy. By putting a price on carbon, they encourage economic players to adopt more sustainable practices and reduce their emissions. However, carbon markets are only one tool among others for corporate carbon offsetting, and must be complemented by other policy and regulatory measures to achieve long-term emissions reduction targets and foster a truly sustainable economy.

🌐 The importance of international cooperation

Carbon markets often operate on an international scale, with the participation of several countries. International cooperation is essential to harmonize regulations, establish common standards and guarantee the environmental integrity of traded carbon credits. International agreements and initiatives, such as the Paris Climate Agreement, play a key role in coordinating global efforts to reduce emissions and promote carbon markets.

How to frame it?

📘 Carbon standards

There are carbon standards such as the Gold Standard, VERRA or UNFCCC (CDM or JI). Each has its own PDD (Project Design Document), which is the project's technical dashboard. They are monitored according to procedures similar to those established by the United Nations Framework Convention on Climate Change. What's more, the CO2 reductions generated are verified by independent bodies, whether UN-accredited or not, according to the quantity of greenhouse gases avoided.

📗 What is the Low-Carbon Label?

A national carbon certification tool piloted by the French Ministry of Ecological and Solidarity Transition, the Label Bas Carbone enables project sponsors to promote their climate-friendly actions through official recognition and financial compensation from economic players committed to corporate social responsibility (CSR) or voluntary carbon funds.

Carbon price

The price of carbon has been integrated to limit the negative impact on the economy and society as a whole. The price of carbon influences carbon offsetting. Everyone emits GHGs through their actions, and these accumulate in the atmosphere and contribute to climate disruption. We are all responsible for our activities and for what we release onto the earth, so putting a price on carbon is like paying for the use of the atmosphere.

Setting a carbon price encourages society and companies to emit less, minimizing their production costs. Consequently, it must be calculated to guarantee the possibility of good economic equilibrium.

Actors have two simultaneous options for action:

✅ Invest in "clean" technologies to reduce consumption and thus cut emissions.

✅ Pay an emissions quota or carbon tax to continue emitting GHGs if the price of carbon is too low to justify investment in cleaner technologies.