How is the price of carbon offsetting calculated?

To reach the goal of carbon neutrality by 2050 (set by many countries and companies), and to be in line with the objective of limiting global warming to 2 degrees, it is necessary to reduce greenhouse gas (GHG) emissions, whether by individuals, companies or governments.

Une première étape est la réalisation d’un bilan BEGES, pour identifier ses principaux postes d’émissions et ses principaux leviers de réduction de ces émissions en quantifiant son empreinte carbone. Toutefois, il arrive que certaines émissions soient incompressibles. Une entreprise, ou un particulier, peut alors recourir à la compensation carbone en achetant des crédits carbone. Il lui faudra alors choisir entre plusieurs labels, projets de compensation carbone, et montants.

The "Compensation Carbone" platform, supported by ADEME, notes an increase in the price per tonne of CO2 on the voluntary carbon offsetting market in 2023. The average price rises from €4.1/tCO2 in 2021 to €6.1/tCO2 in 2022. It also notes an average price of 33€/tCO2 for projects certified by the French Bas-Carbone Label.

IN 2017, according to the French Ministry of Ecological Transition and Territorial Cohesion, carbon credits from so-called "CDM" and "JI" projects sold for 50 cents per tonne of CO2.

Why the discrepancy? In this article, we look at the pricing mechanisms for carbon offsetting.

1. Carbon offsetting, a solution for

2. Two places to trade carbon credits

3. Carbon credit pricing mechanisms

4. The example of the Low-Carbon Label

🌍Carbonoffsetting, a last-resort solution to global challenges.

First, let's take a look at carbon offsetting, its purpose and organization.

Offsetting is based on the principle that a quantity of GHG emitted has the same impact wherever it is emitted. In theory, therefore, reducing emissions at home, or enabling a reduction elsewhere, has the same ultimate benefit on the quantity of greenhouse gases in the atmosphere.

It is therefore possible to purchase carbon credits to offset irreducible emissions (as a last resort). These credits certify a quantity of tons of CO2 avoided (reduced or sequestered) thanks to a carbon offset project. By participating in the financing of the offsetting project, the financier can offset his or her emissions to the amount of his or her purchase, and reduce his or her carbon footprint. One credit is equal to one tonne of CO2 avoided.

However, carbon offsetting is a solution of last resort. It does not cancel out the impact of actual emissions, and can have the side-effect of greenwashingor not encouraging project financiers to reduce their emissions.

The priority is to reduce greenhouse gas (GHG) emissions to minimize their impact on the climate and the environment, as part of a sustainable development approach. The first step in this process is to carry out a GHG emissions assessment, in order to quantify emissions, identify the main sources of emissions, and put in place an effective and relevant action plan.

This reduction in emissions is particularly important in the context of the 2050 carbon neutrality objective, to which many countries (including France) and companies have committed, sometimes even by 2030.

Carbon neutrality means that GHG emissions are fully absorbed by natural carbon sinks (forests, oceans, atmosphere, etc.). To respect the absorption capacity of these sinks and achieve carbon neutrality, it is necessary to reduce current GHG emissions.

📈Twoplaces to trade carbon credits

Carbon credits are traded on two markets : one regulated, the other voluntary. Depending on the type of market, pricing mechanisms differ.

The regulated market enables countries to offset the emissions they emit in addition to their carbon quota (traded on the financial market set up by the Kyoto Protocol), by purchasing credits under " CDM " (Clean Development Mechanism) or " JI " (Joint Implementation) projects. These projects are certified by the UN, and their amount is set by a logic of regulation between supply and demand, as well as other factors. For example, in 2017, according to the French Ministry of Ecological Transition and Territorial Cohesion, carbon credits from JI or CDM projects were selling at around 50 cents, due to a major imbalance between supply and demand (too much supply compared to almost no demand).

Le marché volontaire permet aux entreprises et aux particuliers de compenser volontairement leurs émissions, notamment pour démontrer un engagement écologique. C’est un marché de gré à gré, où vendeurs et acheteurs sont soit directement en relation, soit mis en relation à travers un courtier, et s’échangent les crédits à un montant fixé entre eux. Dans le cadre présenté ici, les acheteurs et financeurs sont mis en relation par un courtier carbone, qui intervient lors des opérations de vente et d’achats de crédit.

The amounts are set according to various criteria that vary depending on the carbon offset projects involved.

💲Carbon credit pricing mechanisms

Carbon credits are fundamentally heterogeneous: they are characterized by their label, their project type, or the co-benefits their project generates. This results in price differentiation, reflecting buyer preferences and project implementation costs.

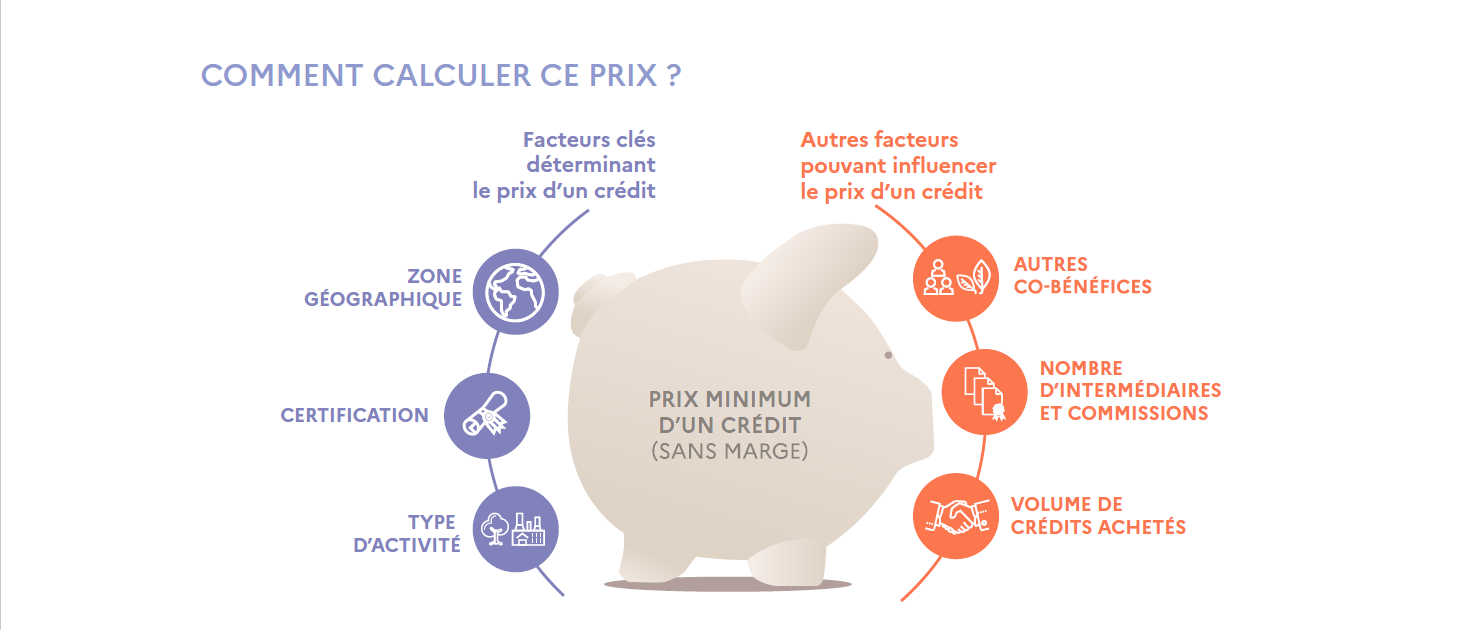

The value of carbon credits is determined by :

- Key factors:

- The geographical area of the project.

- Certification of the offset project (various existing standards and labels).

- Type of activity.

- Other factors :

- The project's other co-benefits: social, economic...

- The number of intermediaries and commissions between buyer and seller (e.g. brokers).

- The volume of credits purchased.

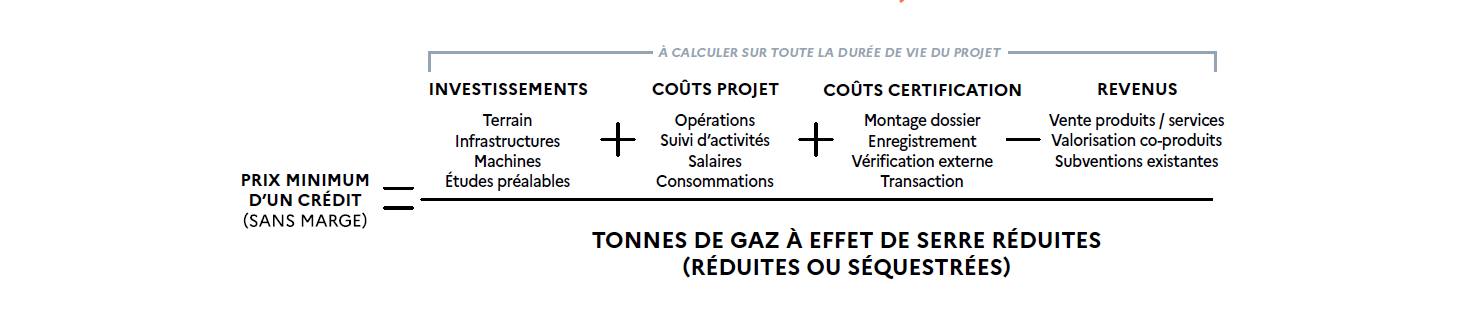

The factors can be summarized as follows:

🇫🇷L thelow-carbon label

The Label Bas-Carbone is a 100% French label set up by the government in 2018 to certify carbon offset projects taking place on French territory.

The amount is calculated on a case-by-case basis, depending on the financier and the project owner. More precisely, the amount is fixed for the entire project, then divided into tCO2 according to the number of tCO2 available for purchase.

Prices therefore depend on the type of project, its location, the existence of public subsidies, the co-benefits generated, and the method used.

This explains the difference between the average price per tCO2 and the average price per tCO2 for the Low-Carbon Label.

Pour aller plus loin, retrouvez les prix d’un bilan carbone.