What is carbon debt?

Every day we delay reducing our greenhouse gas emissions adds to an invisible but very real burden: the carbon debt. This concept, still little-known to the general public but increasingly used by experts and institutions such as ADEME and ABC, translates our failure to meet planetary limits into a concrete figure.

Like a bank overdraft, it measures the gap between our actual emissions and the trajectories compatible with international climate objectives, in particular those of the Paris Agreement. It reveals not only how far we've fallen behind, but also how much effort we need to make to get back on track for a +1.5°C world.

Against a backdrop of increasing regulations (CSRD, European Taxonomy), pressure from stakeholders, and economic upheavals linked to the low-carbon transition, carbon debt is becoming a strategic indicator for companies, local authorities and the State. A better understanding of carbon debt will equip you to act more effectively.

Contents

Defining carbon debt

🤔 What is carbon debt?

The carbon debt corresponds to the accumulation of greenhouse gas (GHG) emissions in excess of the limits set by international climate agreements. It reflects our exceeding the carbon budget compatible with contained global warming. Each tonne of excessemissions adds to the environmental surplus we are passing on to future generations.

For companies, this is reflected in their own mismatch between :

- their actual carbon footprint;

- and a trajectory aligned with +1.5°C or carbon neutrality.

The greater this differential, the greater the carbon deficit, and the more drastic and costly future efforts will have to be.

💥Origin of the concept

The concept of carbon debt, which grew out of the ecological debt debate, is now being used by a number of environmental organizations, includingADEME and theAssociation Bilan Carbone (ABC).

It is now used for :

- better integrate climate into non-financial accounting,

- assess the risks of climate inaction,

- sensitize managers to a long-term vision.

This concept makes it possible to link the climate crisis to tangible economic notions, thus raising awareness in companies and public institutions alike.

In this way, carbon debt helps companies to shift their focus from managing their footprint to managing their accumulated climate liabilities.

❓Link with carbon budget

The global climate is under pressure: according to the IPCC, we have a limited carbon budget to meet the objectives of the Paris Agreement. If current trends continue, this budget will be exhausted before 2030.

According to the IPCC, at the current rate, this budget, compatible with +1.5°C, could be completely used up before 2030.

This implies that :

- every ton counts ;

- each delay increases the deficit to be repaid;

- every company needs to anticipate and integrate this factor into its operational and strategic decisions.

Every delay in the energy transition increases our carbon footprint and makes future actions more complex, more costly, and more urgent.

How to sustain and strengthen your business through a successful low-carbon trajectory.

A strategic tool for companies

✅Carbon Footprint® approach

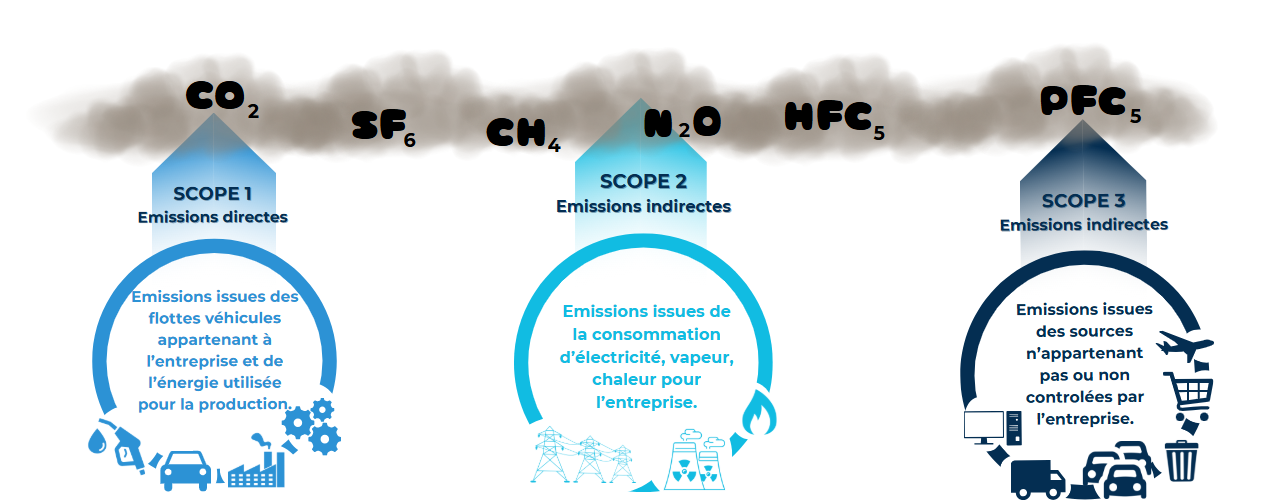

The first step in assessing carbon debt is to carry out a GHG assessment, using a recognized method (e.g. French regulatory method,ABC's Bilan Carbone®, ISO 14064). This assessment enables companies and organizations to identify the origin of their emissions, broken down into scopes 1, 2 and 3.

The first step is to carry out a complete GHG assessment, structured by scopes:

- Scope 1: direct emissions (processes, vehicles, combustion),

- Scope 2: indirect energy-related emissions (electricity, heat),

- Scope 3: other indirect emissions (purchasing, transport, product use, waste, etc.).

Mapping greenhouse gas emissions

Scope 1 and 2 generally represent only 10% to 20% of a GHG balance. Scope 3, on the other hand, is the most significant, accounting for up to 90% of a company's carbon footprint.

This diagnosis is essential for :

- identify priority emission sources,

- quantify its position relative to a target trajectory,

- define concrete reduction actions.

It's an essential step towards understanding its impact and finding effective solutions.

❗What are the risks involved?

Carbon debt is no longer just an ecological concern: it is now taking on a major economic and financial dimension. Companies exposed to carbon debt - particularly those in carbon-intensive sectors - are facing triple pressure: regulatory, reputational and financial.

By 2023, the cumulative carbon debt of intensive sectors in France reached 644 million tonnes CO₂ equivalent, illustrating the scale of the environmental liability to be absorbed. For economic players, this debt translates into increased risks of exclusion from financing, tighter regulatory constraints, and heightened investor vigilance on climate performance.

On a national scale, theaverage carbon footprint per capita amounts to 9.4 tCO₂e, 56% of which is linked to imported emissions. This dependence underlines the decisive role of Scope 3 in supply chains. Since 1990, France's overall carbon footprint has decreased by 13%, mainly thanks to a reduction in domestic emissions (-33%), while those associated with imports have increased by 13%.

For companies, integrating climate risk into performance analyses and financial statements is becoming essential. This means identifying critical emissions, aligning investments with a low-carbon trajectory, and structuring governance capable of anticipating these systemic changes.

💯A lever for transformation and performance

Managing carbon debt is not simply a matter of complying with a regulatory constraint: it is above all an opportunity for strategic transformation, creating sustainable value.

Companies that proactively engage in the measurement, reduction and governance of their greenhouse gas emissions enjoy tangible competitive advantages:

- Enhanced financial attractiveness: economic players committed to a low-carbon trajectory are more likely to attract responsible investors and sustainable financing. Integrating climate risk into the overall strategy reassures financial partners and facilitates access to advantageous financing terms.

- Brand enhancement and stakeholder loyalty: a credible climate policy strengthens the trust of customers, talents and partners. It becomes a differentiating factor in markets that are increasingly attentive to CSR commitments.

- Cost optimization and efficiency gains: reducing emissions often makes it possible to identify levers for energy efficiency, resource rationalization or strategic relocation of purchasing. These are all approaches that reduce expenditure while strengthening resilience in the face of economic fluctuations.

- Regulatory anticipation and business security: by structuring a response ahead of the requirements of the CSRD and other regulatory frameworks, companies avoid emergency adjustments. As a result, they gain in stability, credibility and adaptability.

- Stimulating innovation and strategic alignment: integrating climate concerns into investment, purchasing and production decisions drives the development of innovative, more sober and sustainable solutions. This dynamic permeates the entire organization, becoming a lever for growth.

👉 This is why institutions likeADEME encourage companies to link their carbon strategy to their corporate governance, by placing these issues at the heart of management committees, transformation plans and steering tools.

Acting on our carbon debt means investing in our long-term viability. It means making climate change not a constraint, but a driver for adaptation, operational excellence and sustainable performance.

Reducing carbon debt: from strategy to action

Taking action on carbon debt requires a structured, gradual approach in line with international climate objectives. The most advanced companies base their strategy on three pillars: reducing emissions at source, regulated carbon offsetting, and strengthened governance.. Each of these levers plays a complementary role in implementing a credible and sustainable low-carbon trajectory.

📉Reducing emissions at source

The priority for any organization is to reduce its greenhouse gas emissions directly at source. This step is based on an operational transformation that mobilizes all corporate functions. The main levers include :

- Energy efficiency: modernizing equipment, optimizing industrial processes, improving the thermal performance of buildings.

- Switch to low-carbon energies: electrification of uses, solar self-consumption, use of waste heat, purchase of renewable electricity (PPA, guarantees of origin).

- Sustainable logistics and mobility: greening fleets, pooling transport, relocating production sites.

- Sobriety: rethinking needs, extending product lifetimes, reducing unnecessary or redundant volumes in the value chain.

These actions must be quantified, planned over time, and integrated into a global roadmap aligned with a trajectory compatible with the Paris Agreement (e.g.: -50% by 2030). They form the basis of a credible transition plan.

♾️Compensation and carbon sinks

Even with an ambitious reduction strategy, some residual emissions remain unavoidable, particularly in complex sectors such as air transport, agriculture and heavy industry. Carbon offsetting makes it possible to neutralize these emissions through positive actions for the climate:

- Natural carbon sinks: reforestation projects, agroforestry, wetland restoration, preservation of existing forests.

- Capture technology solutions: geological storage of CO₂, direct air capture (DACCS), bioenergy with capture and storage (BECCS).

- Certified projects with high co-benefit impact: those that integrate social, economic or biodiversity dimensions.

However, offsetting never replaces the obligation to reduce. It is part of a climate responsibility approach once all internal levers have been activated. Best practices recommend using recognized labels (Gold Standard, Verra, Low-Carbon Label) and ensuring that offset projects are part of a transparent, auditable framework that can be monitored over time.

💚Governance, innovation and support

For a climate strategy to produce lasting results, it needs to be managed at the right level. This requires solid governance, an aligned corporate culture and appropriate monitoring tools. The key levers are :

- Create cross-functional carbon governance: appoint a dedicated manager or team, link carbon strategy to management bodies, integrate climate indicators into executive committees.

- Train and mobilize employees: raise teams' awareness of carbon issues, offer targeted training, foster a culture of collective responsibility.

- Invest in low-carbon innovation: eco-design, circularity, alternative materials, artificial intelligence for energy optimization.

- Rely on external expertise: support from specialized partners such asADEME, theAssociation Bilan Carbone (ABC) or expert platforms (such as Global Climate Initiatives) facilitates skills development and operational efficiency.

Last but not least, climate strategy cannot stand alone. It must be integrated into the company's overall strategy, its purchasing processes, investment decisions, risk management and supplier relations.

Carbon debt is not just an environmental abstraction. But far from being a pessimistic observation, this concept offers a strategic key to steering the low-carbon transition. By measuring it accurately, acting on emissions at source, integrating reliable offsetting solutions and strengthening their climate governance, organizations can transform a risk into a performance lever.

👉 Global Climate Initiatives is fully in line with this dynamic. As an expert platform, GCI supports companies, local authorities and institutions at every stage of their low-carbon transition:

- Rigorous measurement of emissions (Bilan GES, scopes 1, 2 and 3),

- Definition of trajectories in line with climate objectives,

- Steering concrete reduction and compensation actions,

- Reporting in line with regulatory standards (CSRD, SBTi, European Taxonomy).

In the face of accelerating climate challenges, the time for waiting is over. Act today to preserve tomorrow. It is in this spirit of positive transformation that GCI stands alongside all ambitious organizations.